Time to read : 4 Minutes

Why It's Important To Teach Your Kids About Money In A Digital World

As physical cash gives way to the ubiquity of digital currency, where does that leave our kids? It might not be one of your top considerations, but a lack of financial literacy can start your children off on the wrong foot when they reach adulthood.

Unfortunately, Aussie kids’ financial knowledge is declining, with those in disadvantaged homes and lower socioeconomic areas most at risk of forming bad money habits early on.

🧮 So the best time to start teaching your kids about money in a digital world is right now.

With Aussie kids’ financial knowledge in decline, it’s time parents stepped up to the plate and started modelling good money behaviours.

The current generation of kids and young adults are known as the ‘invisible money generation’.

Even with the best of intentions, it’s easy to make common mistakes when teaching kids about money – such as forcing them to save every cent they receive.

Something as simple as setting up a kid’s savings account can help give your child access to broader financial knowledge.

Five common mistakes that parents make

Kids and young adults today are in living in an incredibly different financial environment compared to their parents and grandparents. The dearth of physical cash and abundance of digital payment options means those born after the year 2000 have been dubbed the invisible money generation.

Education is key, but many parents make these all-too-common mistakes when it comes to financial lessons:

🤫 Staying silent

It might be a tough conversation to get started, but avoiding the subject of money completely means your kids won’t have the benefit of learning about complex financial concepts and how to be responsible with money from a young age.

💸 Controlling their money

As parents we like to think we always know what’s best for our kids, but not letting them have any say in how their money is spent can have a detrimental impact on their financial confidence. So instead of always being in control of their spending, give them some freedom and let them learn the consequences of their actions – within reason, of course!

📏 Forcing them to save every cent

If there’s one things kids love doing when their parent asks them to do something, it’s the opposite! While it’s completely understandable that you want your child to learn about good savings habits from a young age, forcing them to put every cent in the bank will likely cause an adverse reaction, and create a ‘me-versus-them’ mentality around money and savings.

🛒 Shopping solo

It might not seem all that important, but the simple act of bringing your child with you on grocery and shopping runs can help them passively understand more about money, currency (digital and physical) and budgeting for the weekly shop.

🎁Don’t forget about generosity

Equally as important as teaching your kids to be financially responsible is showing them the value in generosity. Don’t neglect this aspect of their financial education – modelling generosity through your own actions can have myriad positive effects on your child’s development.

Four strategies to teach your kids to be financially responsible

Making mistakes is part of being a parent. So rather than worrying that you’ve been teaching your kids the wrong things about money, start putting into practice some effective strategies that they will be able to lean on for the rest of their lives:

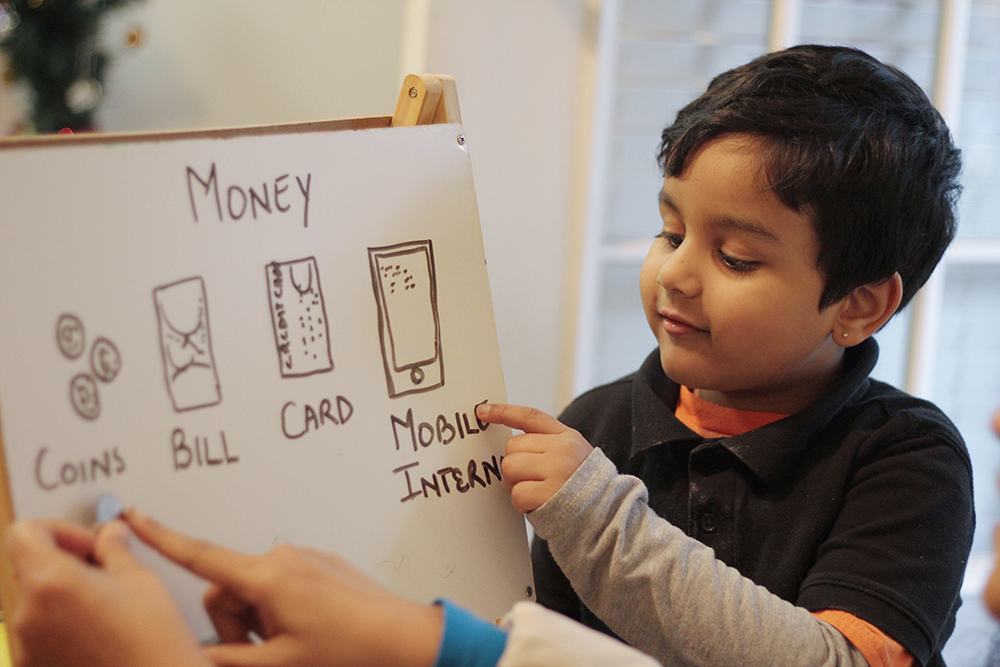

💻 Teach them about physical and digital money

Next time you need some cash, bring the kids along with you. They’ll probably get a kick out of seeing physical money come out of an ATM, and you can also show them that your bank balance decreases with every withdrawal you make. Also show them how you use your online banking account – including things like auto-transfers, using savings calculators, and paying for bills with BPAY.

🏦 Set them up with a savings account

Most banks these days allow parents to open up savings accounts for their children. It’s not only a great way to educate your kids about how to be a good saver and how long it takes to reach certain financial goals, but it can also be a way for you to save for their future education costs.

✅ Set savings goals for online purchases

If your child really wants to buy something, make them save up for it. Once they hit their goal, get them to actively go through the process of making the purchase online, so they can see what a regular digital transaction looks like.

💳 Take advantage of prepaid money cards

Digital currency will be a staple of your children’s adult lives, so gifting them a prepaid money card could be much more educational than giving them physical cash. You can load it up with a set amount and then let them make their own decisions around money. When they want to know how much they have left, rather than counting their dollars and cents they can jump online and see what’s left on their card.

The bottom line

Even if you grew up only using cash, the reality is that we’re living in a digital world and we all need to adapt to it!

If you want your kids to grow up as financially savvy and confident individuals, you need to start teaching them about the value of a (digital) dollar today.

🔍 And if you ever feel out of your depth, just remember that there is plenty of help out there – from online resources to self-help books to financial advisors. Your kids deserve the best possible start!

Financial Disclaimer: