Time to read : 2 Minutes

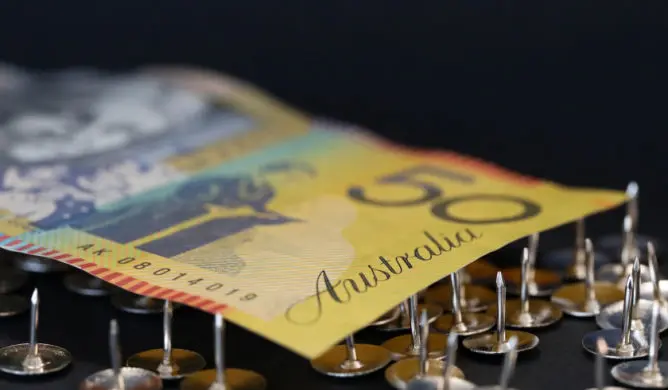

Another Interest Rate Rise Hits Australian Home Owners Hard

The Reserve Bank of Australia (RBA) increased the cash rate by 0.25 per cent today, taking the rate to 4.1%. But as inflation pressures rise and cost-of-living struggles reach new heights, why are house prices going up, not down?

The RBA rate rise announcement

While many experts says recession is, officially, unlikely, the continued housing headache is set to cause stress for both renters and homeowners with a mortgage.

According to Ray White Chief Economist, Nerida Conisbee, "if we want everyone to have a roof over their heads, it would be a good idea for the increases to stop now".

However, she also believes that what she describes as the RBA's "narrow path" looks like getting us through recession-risk, while still taming inflation.

But with renters, buyers and new housing supply about to experience new levels of pain, Ms Conisbee says that the impact will be felt for many years to come. And, house prices will most likely keep rising.

Because, although early predictions were that interest rate rises would lead to housing prices falling, it seems, says, Ms Conisbee, that the opposite is proving true.

In fact, according to CoreLogic, prices will be 4% higher at the end of 2023 – a figure that challenges the previous forecasts that the Australian property market would see drops of 10% and more.

"Rents are rising at their most rapid rate ever recorded, housing approvals are now at their lowest level in more than a decade and this housing shortage pressure is now flowing through to house prices", she said in a post-rate rise announcement statement earlier today. "Rising rates are part of the problem."

"Prices are moving upwards," she said. "Although seemingly counterintuitive in a high interest rate environment, it is reflective of what is happening in the rental market. Population growth is strong and there are too few homes. Added to this, however, is that sellers are sitting on their hands."

That hand-sitting means that new listings are down by more than 20 per cent.

And with less product on the market and many people still desperate to enter the housing market at any price, increased competition will likely see prices continue to climb.

In The Guardian, ACTU secretary, Sally McManus, described the RBA as "hell-bent on crushing consumers" and continuing to "punish those who did nothing to cause this cost-of-living crisis”.

“This is the wrong decision,” McManus said. “An action which is designed to put more pressure on those who cannot afford it and to push up unemployment.”

The bottom line:

With more interest rate rises still predicted, Ms Conisbee pointed to the dynamic nature of property cycles and pulled no punches when it came to predicting a challenging future for buyers, renters and builders.

"No property cycle is ever exactly the same and this time around, interest rate rises are making housing so much more expensive whether you want to buy, rent or build."

Go deeper: Everything you need to know about refinancing

Financial disclaimer

The information contained on this web page is of general nature only and has been prepared without taking into consideration your objectives, needs and financial situation. You should check with a financial professional before making any decisions. Any opinions expressed within an article are those of the author and do not specifically reflect the views of Compare Club Australia Pty Ltd.