Time to read : 5 Minutes

Most of us have huffed and puffed over the price of a last minute flight or hotel room, or when petrol prices jump up right before a long weekend. That’s an example of dynamic pricing – when prices rise during periods of higher demand.

What if the price you pay wasn’t determined by demand as a whole, but based on how much a retailer believes you – as an individual – are willing to pay? This is personalised pricing, and it’s on the rise.

What is personalised pricing?

Personalised pricing is a pricing strategy where customers pay different prices based on their buying behaviour and personal characteristics.

Information, also known as data, is collected from your:

online browsing history

purchase history

location

interests.

Personalised pricing is also referred to as ‘surveillance pricing’ as there’s ongoing monitoring of consumer behaviour.

How personalised pricing could work

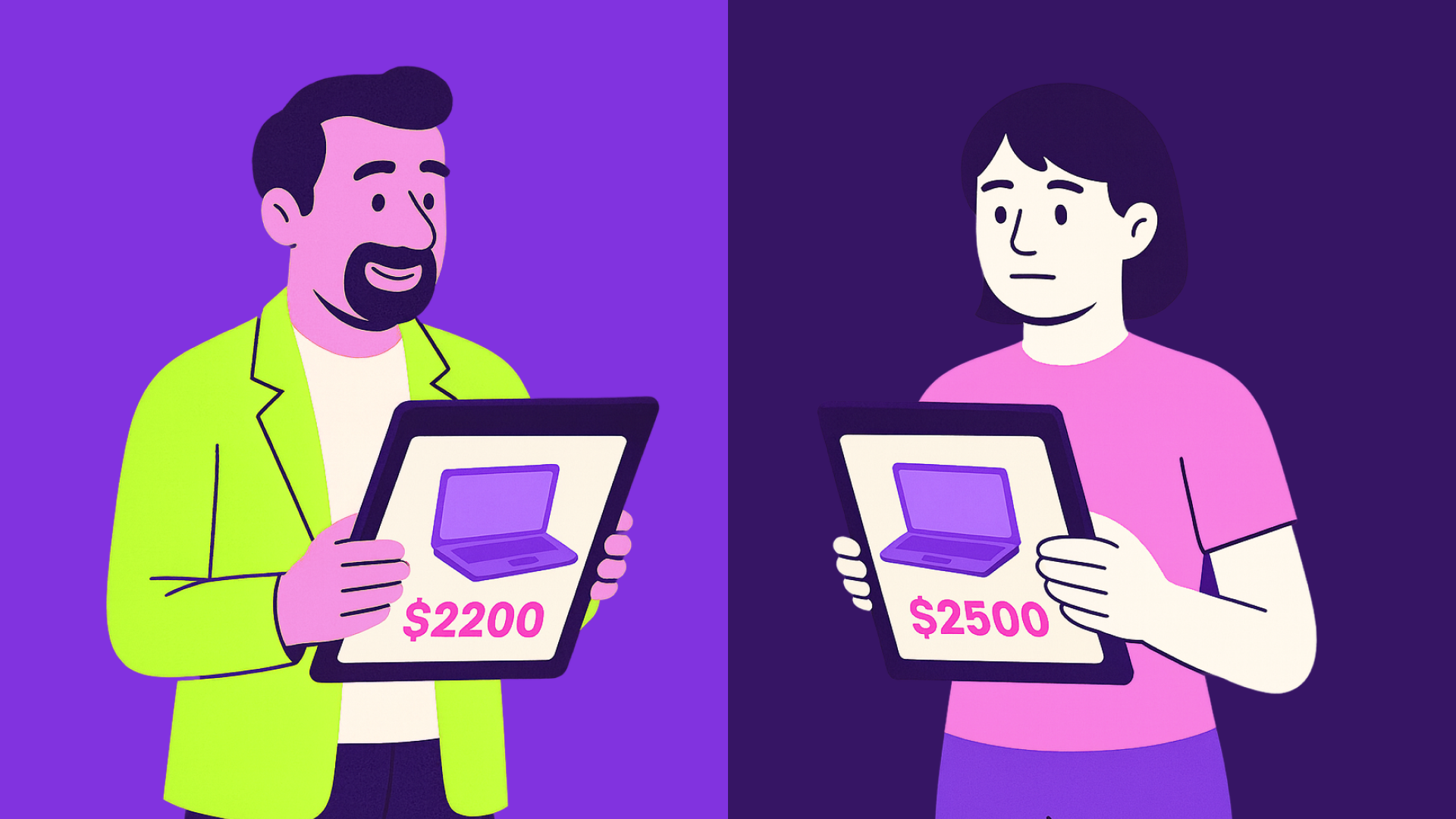

Let’s say customer A and customer B are interested in buying the same model laptop from Larry’s Lappies.

This is what the retailer knows about the two customers:

Customer A is in their mid-40s, lives in an affluent area of Sydney, and their purchase history suggests they have a fairly high disposable income. They’re loyal to the Larry’s Lappies brand as they have purchased many other items from the retailer.

Customer B is identified to be a younger person, a student living in a more regional part of NSW. Their online behaviour suggests they’re a bargain hunter, and may shop around for the best deals.

Based on these differences, Larry’s Lappies sees customer A to be willing to pay more for the laptop and less price sensitive than customer B.

So what does this mean? Customer A sees the laptop priced at $2,500, while customer B sees the laptop priced at $2,200.

In some cases, personalised pricing may provide a better outcome for some consumers, especially those who are more price sensitive or who may be identified to have less disposable income.

In this example, customer B gets the laptop for a lower price because the retailer has identified the sweet spot that balances their price sensitivity with their need and desire for the item.

Yes, but… there’s a much more sinister side to personalised pricing. Retailers having access to so much of our data could mean we’re soon charged higher prices for goods we need in a hurry. Our interests, desires and impulses may be used for profit more than ever before.

And lower income earners are at risk of being taken advantage of. Aussies with lower incomes who may be struggling financially are generally less equipped to research and select their purchases. So retailers could show products at higher prices to customers it knows can’t easily shop around.

Be aware: personalised pricing is ultimately about retailers nudging you over the decision line when considering a purchase. Personalised pricing almost always results in more profit for the retailer.

Is personalised pricing legal?

Under Australian Consumer Law, businesses are permitted to adjust prices in line with supply and demand, but must not mislead consumers about what they'll be charged or why.

But the fast-growing use of data and technology – like with personalised pricing – can outpace any relevant industry regulations. The ACCC is likely to be paying close attention to retailers using personalised pricing so customers aren’t being misled.

Also, using customer data for personalised pricing raises concerns around privacy and consumer protections. Retailers must also comply with the Australian Privacy Principles, and be transparent about how and why they are collecting and using consumer data.

How personalised pricing can be used through loyalty programs

Loyalty programs and apps are currently the main way we’re experiencing personalised pricing here in Australia. If you’ve wondered why everywhere seems to have an app now – this is why. Apps allow retailers to view your purchase behaviour in one neat little package, and deliver you offers and discounts that make you more likely to purchase.

For example, if you always buy your brekkie roll and coffee on a Friday on the way to work, the retailer is pretty confident that you’ll keep buying at that time without nudging you. There’s no need to offer you an incentive.

But Mondays on the other hand may be a different story. You might be sent tempting offers to entice you to buy at a time you usually wouldn’t.

What can you do about personalised pricing?

Personalised pricing is unsettling. Privacy concerns are one of the main reasons consumers are resistant to it, especially with the rise of AI and the growing use of algorithms to target consumers.

As a starting point, it can help to learn more about where your data may be captured...

What apps are you using?

What information are you providing to companies?

What marketing emails have you consented to?

Retailers are beginning to face challenges as consumers become more cautious about their digital footprint. This includes taking actions like rejecting cookies or using Apple’s ‘Ask App Not to Track’ feature that blocks some elements of data collection.

And businesses know that if customers get wind of what appears to be unfair pricing, they risk damaging trust and brand loyalty.

If you’re particularly concerned, you can take steps to distance yourself from personalised pricing by:

Using cash when you shop. Cash can’t be tracked.

Deleting profiles from loyalty programs and shopping independently of personalised offers and discounts. This prevents retailers from seeing your consumption patterns.

Research and track prices manually, or using a browser extension like BuyWisely that tracks price changes across the web. This makes you more aware of price variations, which brands don’t want.

Use a VPN to block your IP address from being visible to reduce the ability for your data to be used to feed algorithms.

Interrogate special offers and things that entice you to purchase, and really try to focus on what you want to spend your money on, regardless of how good of an offer you’ve been given.

Bottom line

Personalised pricing has well and truly arrived in our retail landscape. Being aware of it can help you recognise where your decisions might be manipulated by a personalised offer. And knowing this can help you make more informed purchasing decisions.

Remember, you can take some steps to minimise how your buying behaviours are tracked. It might take a bit of effort – and be a little inconvenient – but it could be the best shot you have of keeping your shopping private and avoid paying the price.

Go deeper:

Financial disclaimer

The information contained on this web page is of general nature only and has been prepared without taking into consideration your objectives, needs and financial situation. You should check with a financial professional before making any decisions. Any opinions expressed within an article are those of the author and do not specifically reflect the views of Compare Club Australia Pty Ltd.