Time to read : 2 Minutes

The Australian Securities and Investments Commission (ASIC) has called on 30 major lenders to provide more support for customers facing financial hardship.

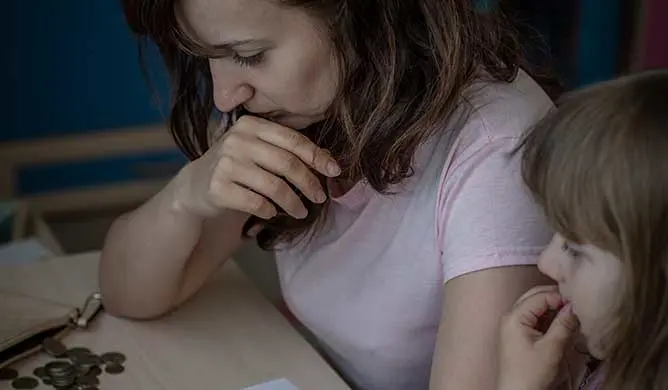

Escalating cost-of-living pressures mean an increasing number of Australians are struggling with financial distress and difficulties.

Key points (TL;DR):

ASIC calls on major lenders to provide better support for customers dealing with financial hardship.

An open letter to lenders emphasises their obligations and the need for proactive steps to help struggling families.

ASIC to review 10 home lenders' approach to financial hardship, with findings to be released in 2024.

The regulator wants fair and efficient credit activities in accordance with the National Credit Code.

ASIC's Moneysmart website and the National Debt Helpline offer guidance and assistance for consumers.

Even ASIC's commissioner Danielle Press knows that everyday Australians are under significant financial strain.

As a result, she's pushing lenders to introduce systems and processes to help consumers who find themselves in financial hardship.

In an open letter to lenders, ASIC emphasises the need for lenders to fulfil their obligations in supporting struggling customers.

The regulatory body expects them to carefully consider the requirements highlighted in the letter and take proactive steps to address the situation.

Who received ASIC’s letter?

Allied Credit Pty Ltd

American Express Australia Limited

AMP Bank Limited

Australia and New Zealand Banking Group Limited

Bank of Queensland Limited

Bendigo and Adelaide Bank Limited

Bluestone Mortgages Pty Ltd

Commonwealth Bank of Australia

Credit Union Australia Limited

Firstmac Limited

Heritage and People's Choice Limited

HSBC Bank Australia Limited

Humm Group Limited

ING Bank (Australia) Limited

La Trobe Financial Asset Management Limited

Latitude Group Holdings Limited

Liberty Financial Group Limited

Macquarie Group Limited

MoneyMe Limited

National Australia Bank Limited

Newcastle Greater Mutual Group Ltd

Nissan Financial Services Australia Pty Ltd

Pepper Money Limited

Plenti RE Limited

Resimac Limited

Suncorp-Metway Limited

Toyota Finance Australia Limited

Volkswagen Financial Services Australia Pty Ltd

Westpac Banking Corporation

Zipmoney Payments Pty Ltd

Over the next 12 months, ASIC has identified financial hardship as an area of heightened focus. The organisation will collect data from 30 major lenders to gain insights into hardship applications.

Additionally, ASIC will be conducting a thorough review of 10 leading home lenders to gain a comprehensive understanding of their approach to financial hardship.

The findings from this review are expected to be released in early to mid-2024. By proactively engaging with lenders, ASIC aims to promote fair and efficient credit activities in accordance with section 72 of the National Credit Code.

As part of these regulations, credit providers are obligated to consider modifying a customer's credit contract if they indicate their inability to meet their credit obligations. Furthermore, credit providers must conduct their authorised credit activities honestly, efficiently, and fairly.

ASIC's call for lenders to prioritise customer support in times of financial difficulty underscores the importance of ensuring consumers receive the assistance they need.

By compelling lenders to assess and address their obligations, ASIC aims to cultivate an environment where families and individuals can surmount their financial challenges with the appropriate support and resources.

The Bottom Line

Are you facing financial hardship? Head to ASIC's Moneysmart website for valuable information on the necessary steps to take.

Even if you have multiple debts or require assistance, contact the National Debt Helpline at 1800 007 007. Trained financial counsellors are there to provide free financial guidance.

You can also contact your lender and find out what measures it has in place to help you.

Go deeper: Mortgage holders struggling to refinance their home loan doubles in under six months

Financial disclaimer

The information contained on this web page is of general nature only and has been prepared without taking into consideration your objectives, needs and financial situation. You should check with a financial professional before making any decisions. Any opinions expressed within an article are those of the author and do not specifically reflect the views of Compare Club Australia Pty Ltd.