Time to read : 5 Minutes

I Owe My Home To The Bank Of Mum And Dad Do You

I never would have been able to buy a home without my parents.

I am not alone either, the bank of mum and dad is Australia's ninth biggest lender with 60% of us needing their help to get on the property ladder. Our parental bank is worth a whopping $34bn.

🐢 At the rate I was saving, it would have taken me eight and a half years to save my 20% deposit and stamp duty.

It wasn't an easy journey but I am so glad that I did it:

🤔 Along the way I learned about all the costs you need to consider when saving.

☠️ The perils of finding the right place and then negotiating for the best price.

💸 And how I got a mortgage as a casual employee too.

My first home (and likely, last) was $860K in Sydney's Eastern Suburbs

Over the last 10 years, my average salary was $100K plus or minus 10% – which is about the Australian average of $92K.

So let's say I save 15% a year – the experts recommend you save 10-20% of your salary – or $15K, which is $1250 a month.

In order to save $86K, I would need to save for six years. To cover $36K of stamp duty, another two and a half years.

⏲️ Total saving time: 8.5 years.

The trouble is, I would have saved that by now... nine years later.

Today, my property, even with the drop in the market is worth $1.4m.

That means that my deposit of $86K, would now need to be $280K. My stamp duty would now need to be $61K.

Which literally means, I would need to save for another 13 years to pay my deposit and another year and a half for my stamp duty.

Total saving time: 23 years.

... by which time of course, the market would have moved – again.

😭 Buying in Sydney was impossible for me.

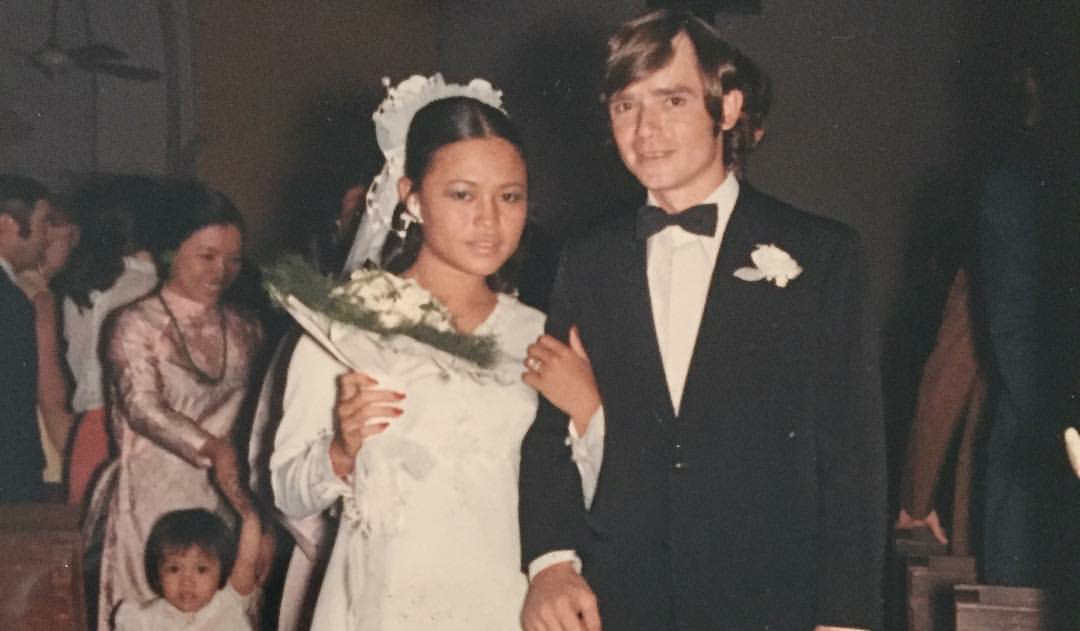

Enter... my amazing parents

I am incredibly lucky and my mum and dad decided to give me an early inheritance to get into the market nine years ago.

They sold the investment property that I was living in to boost their super and to give me a $250K deposit for my first home.

It was, and is, the most incredible gift and it means as a single woman on one income that I am set up for my life.

With their generous and sizeable deposit I was able to:

💰 Avoid Lenders Mortgage Insurance or LMI, because I had more than a 20% deposit – mine was nearly a 30% deposit.

🛒 Get into the market before I had saved up for the full deposit at a time that house prices were more affordable in the East.

🤝🏻 It also helped me as a borrower in the bank's eyes and in the end I negotiated, with a broker's help, for a good deal – 4.74% at the time.

🌈 I was also considered a good buyer by the agent because I had such a sizeable deposit for the home.

The hardest part as it turned out was getting a mortgage because I was employed as a casual...

Ironically I had only just moved from being a full-time employee to a casual fitness instructor which made it so much harder to get a loan.

Even though I had a great deposit, I needed to jump through a variety of hoops to prove I could pay the mortgage:

The bank added a 3% buffer to my 4.74% or 7.74% to make sure I could pay the mortgage. I had to prove with my last 12 months of pay slips that I could meet that buffer repayment.

I had been working for the same employer as a casual employee for over 10 years, so they had to write a letter verifying my longterm employment. The bank also only counted 75% of that salary against the loan – a common thing for self-employed or casual employees.

I also had to show my tax returns for the last two years which included my full-time income and part-time fitness income.

😮💨 In the end, I just scraped in. Which, to be honest, I am really grateful for right now with interest rises creeping up and knowing that I can service 7.74% if I have to.

It is the best financial decision I have ever made

I still remember the day I signed the mortgage papers. I felt sick at taking on that much debt and that feeling of nausea lasted the first few months in the home.

AND then it got normal.

Looking back now, almost 10 years later, I am so glad that I took the leap and got my own place.

🪜 Yes, I had the most amazing leg up – and for that I'm going to be eternally grateful.

👩💻 But I have worked my butt off to hold onto the property through illness, job changes and covid lockdown.

🏰 It's not a mansion, but it is my castle and my current mission is to pay it back as soon as I am able to.

I have no regrets.