less than

2 mins

Private health insurance for hysterectomy treatments

Key Points

A hysterectomy is an operation to remove the uterus, and sometimes the cervix, ovaries or fallopian tubes

Public hospital patients in Australia wait an average of 61 days for a hysterectomy operation

Choosing the right private health insurance policy could save you hundreds or even thousands of dollars on out-of-pocket hysterectomy costs

It’s a major decision to remove your womb, even when it’s recommended by your doctor or gynaecologist.

You’ll probably be thinking about everything from the operation itself to side effects and potential costs - and whether or not you need private health cover.

In this guide, you’ll learn about the different types of hysterectomies, what’s involved and what you can expect to pay with or without private health cover.

COMPARE & SAVEWhat is a hysterectomy?

A hysterectomy is an operation to remove the uterus (womb), with or without the cervix (or the neck of the womb). Sometimes the ovaries and fallopian tubes are removed at the same time.

A hysterectomy is a major operation but is also one of the most common elective surgeries performed in Australia and considered a safe procedure.

Common reasons for hysterectomies include:

Cancer of the uterus, cervix, ovaries or fallopian tubes

Fibroids (benign tumours) in the uterus

Menstrual issues such as consistent heavy bleeding or severe pain

Endometriosis: a painful condition where the lining of the uterus grows outside the uterus

An enlarged or prolapsed uterus

Pelvic inflammatory disease

Depending on your condition, your doctor might suggest other treatments or surgeries first before recommending a hysterectomy.

As a general rule of thumb, if you have a hysterectomy you can expect to stay in hospital for a couple of days and have a recovery period of four to six weeks.

Learn more about health insurance with these guides

What are the different types of hysterectomy?

There are three main types of hysterectomies:

Abdominal: the uterus is removed through a cut in the lower abdomen

Vaginal: the uterus is removed through the vagina

Laparoscopic: instruments are passed through small incisions in and near the belly button

Sometimes a hysterectomy involves a combination of the methods above. Your doctor or surgeon will talk you through the best type for your situation.

What are the side effects of a hysterectomy?

After a hysterectomy, you won't be able to lift heavy objects or do anything strenuous for four to six weeks. There might also be vaginal bleeding and discharge for up to a few weeks after the operation.

Less common side effects include:

A reaction to the anaesthesia, such as nausea, breathing or heart problems

Internal bleeding or scar tissue

Blood clots

Injury to surrounding organs

Decreased or increased libido

Feelings of grief or loss

Most women don’t experience serious side effects after a hysterectomy. Talk to your doctor if you’re worried about any potential complications.

How much does a hysterectomy cost?

The cost of a hysterectomy depends on several things.

Medicare will cover the cost of the operation and treatment if you’re admitted as a public patient in a public hospital.

However, if you have the surgery performed as a private patient in a public or private hospital, doctors or surgeons may charge fees above what Medicare will cover, leaving you with out-of-pocket costs.

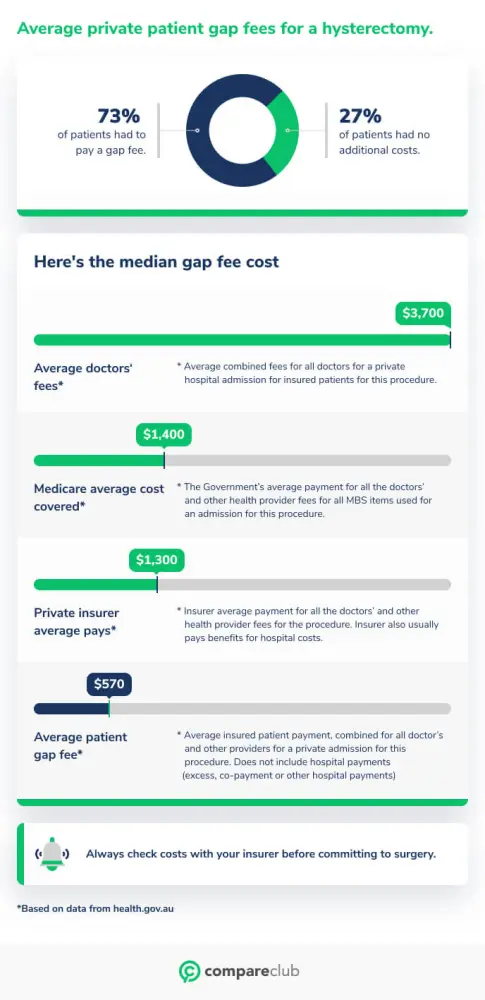

Average private patient gap fees for a hysterectomy

73% of patient had to pay gap fee.

27% of patient had no additional costs.

Here's the median gap fee cost

Always check costs with your insurer before committing to surgery.

It’s also worth noting you’ll be waiting an average of 61 days for hysterectomy surgery in a public hospital. And as a public patient, you generally have less choice about the type of care you receive.

If you have private health insurance, Medicare will generally cover 75% of the cost of the medical costs associated with a hysterectomy and your insurer will cover some or all of the remainder.

In 2019-2020, 27% of private patients paid nothing for a hysterectomy. For those who paid a gap fee, the average out-of-pocket cost was $570.

Does private health insurance cover hysterectomy surgery?

Hysterectomies are usually covered under a medium level of private hospital cover. Unless your insurer has a no gap arrangement with your doctor or surgeon, you might have to pay out-of-pocket costs even if your policy covers hysterectomies.

It’s a good idea to compare multiple cover options as some will offer better value for money than others for hysterectomy surgery.

It’s also worthwhile doing research well in advance, as some insurers have waiting periods before you can make a claim.

If you’re looking for private health insurance that covers hysterectomies, you can quickly and easily compare policies by clicking the button below. We saved Australians an average of $312 in 2020* when they compared and switched with us.

COMPARE & SAVEWhat's new in health insurance?

Biggest hike in years: Health insurance premiums will rise by an average of 4.41% on April 1 — the largest hike since 2018 and noticeably higher than last year’s increase of 3.73% (in 2025).

Most Aussies face higher hikes: Compare Club’s data suggests that due to the five largest funds holding nearly 80% of the market, the average increase for the majority of policyholders is closer to 5.00%.

Review your policy: Now’s the time to check if your policy still fits—better deals could be available.

Sources

*Based on 25,311 customers in 2020. Health.gov.au, Medicare Benefits Schedule, April 2021.

Things You Should Know

*As our customer you'll be provided with quotes directly from the insurer for the product you intend to purchase. We manage the application and deal with the administration work and insurer. We do not charge you a fee for the service we provide, the insurer simply remunerates us in return for setting up your policy. The financial and insurance products compared on this website do not necessarily compare all features that may be relevant to you. Comparisons are made on the basis of price only and different products may have different features and different levels of coverage. Compare Club does not compare all policies available in Australia and our partner insurers may not make all policies available to Compare Club.

This guide is opinion only and should not be taken as medical or financial advice. Check with a financial/medical professional before making any decisions.

Chris Stanley is the sales & operations manager of health insurance at Compare Club. With extensive experience and expertise, Chris is a trusted leader known for his deep understanding of health insurance markets, policies, and coverage options. As the sales & operations manager of health insurance, Chris leads a team of dedicated professionals committed to helping individuals and families make informed decisions about their health insurance needs.

Meet our health insurance expert, Chris Stanley

Chris's top health insurance tips:

- 1

Australia’s public health system is world-class, but wait times for public hospitals can be long, inconvenient - and leave you living in constant pain while you wait.

- 2

An appropriate private health insurance policy can speed up your surgery, relieving your pain sooner.

- 3

Family health cover means your children are covered under the same policy as you.

- 4

Many health insurance policies come with a 12-month waiting period for pregnancy-related cover, so it’s a good idea to get a family policy organized well before starting your family. This means your child will be covered from birth until at least their early twenties (depending on which health fund you select).