Time to read : 4 Minutes

In the world of investing, ‘analysis paralysis’ refers to a situation where an individual becomes so overwhelmed by the information and choices available, that they are unable to make a decision.

This state of over-analysing can lead to missed opportunities and hinder your investing journey. This can occur in all areas of your life.

Think about a task in your life that you’ve procrastinated about and become overwhelmed with:

starting an assignment

going for a run

doing your taxes, or

replying to that annoying email.

Once we start the task, we often find that it isn’t as bad or as hard as we made it out to be in our head. Plus, getting started is just half the battle.

Here are some ways you can overcome analysis paralysis.

Set clear investment goals

It’s hard to start investing and to figure out your investment plan if you don’t know why you're investing or for how long. Setting clear goals will give you something to work towards.

Simplify your choices

Instead of trying to compare every broker and every ETF (exchange traded fund), focus on a few and pick one of those. You can always change your mind later. The goal here is just to get started.

Consider the opportunity cost

Does that 0.01 difference in ETF management fees or the 50 cents in brokerage really make a difference if you’ve spent 6 months searching for the right one for you? Probably not.

But waiting an extra year to get started can have a big impact.

Educate yourself, but set limits

With social media and the internet, there are multiple resources available to help you learn about investing. Making educated decisions is important, but too much information can be counterproductive.

Pick one book and one podcast to start with or set time limits on researching and prioritise getting started.

Start small

Imagine trying to learn to ride a bike and all you do is read about riding bikes, but you never actually get on one. At some point, the only way to learn will be to get on the bike. No-one expects you to be doing the Tour de France on your first day!

It's the same with investing: you can start with $5 on a micro-investing app (which is a platform that invests smaller amounts), or by investing $500 in an ETF using a share-trading platform or broker platform, and go from there.

Look at diversified options

Instead of trying to pick the perfect share or the perfect mix of ETFs, have a look at diversified options such as a diversified ETF or a pre-mixed micro-investing option.

Accept imperfection

You don’t need a perfect plan to get started, and your plans will change as your life and goals change. Accept that you will make mistakes or won’t be able to find the ‘perfect’ ETF, broker or plan.

Consider automating things

Reduce any friction points that are preventing you from getting started and remove any hurdles that can keep you from being consistent.

Treating your investing like a bill and automating it so it happens in the background means it's more likely that you'll be consistent and stick to it over the longer term.

Set times to review your investment

Instead of checking your investment every day or week and feeling overwhelmed, enter dates into your calendar to remind you to review how things are going and whether you want to change anything.

Give yourself a deadline

Set yourself a date by which you will have decided which broker you are going to invest with, or by when you will have picked an ETF.

Seek advice

If you find yourself constantly getting stuck and overwhelmed, it may be worth getting some professional advice.

Analysis paralysis is a common challenge across many areas of our lives, but especially with investing. Choose some or all of the suggestions listed above to overcome it – find what works for you so you’re able to get started.

Bottom line

Personal finance and investing is a journey, and you'll need to adapt and learn as you go.

The challenge is that we’re often our own worst enemy, creating roadblocks for investing by telling ourselves things like:

I’m not ready yet.

I need more money to get started.

I don’t want to make a mistake.

But these are all just excuses, and often they’re due to... analysis paralysis.

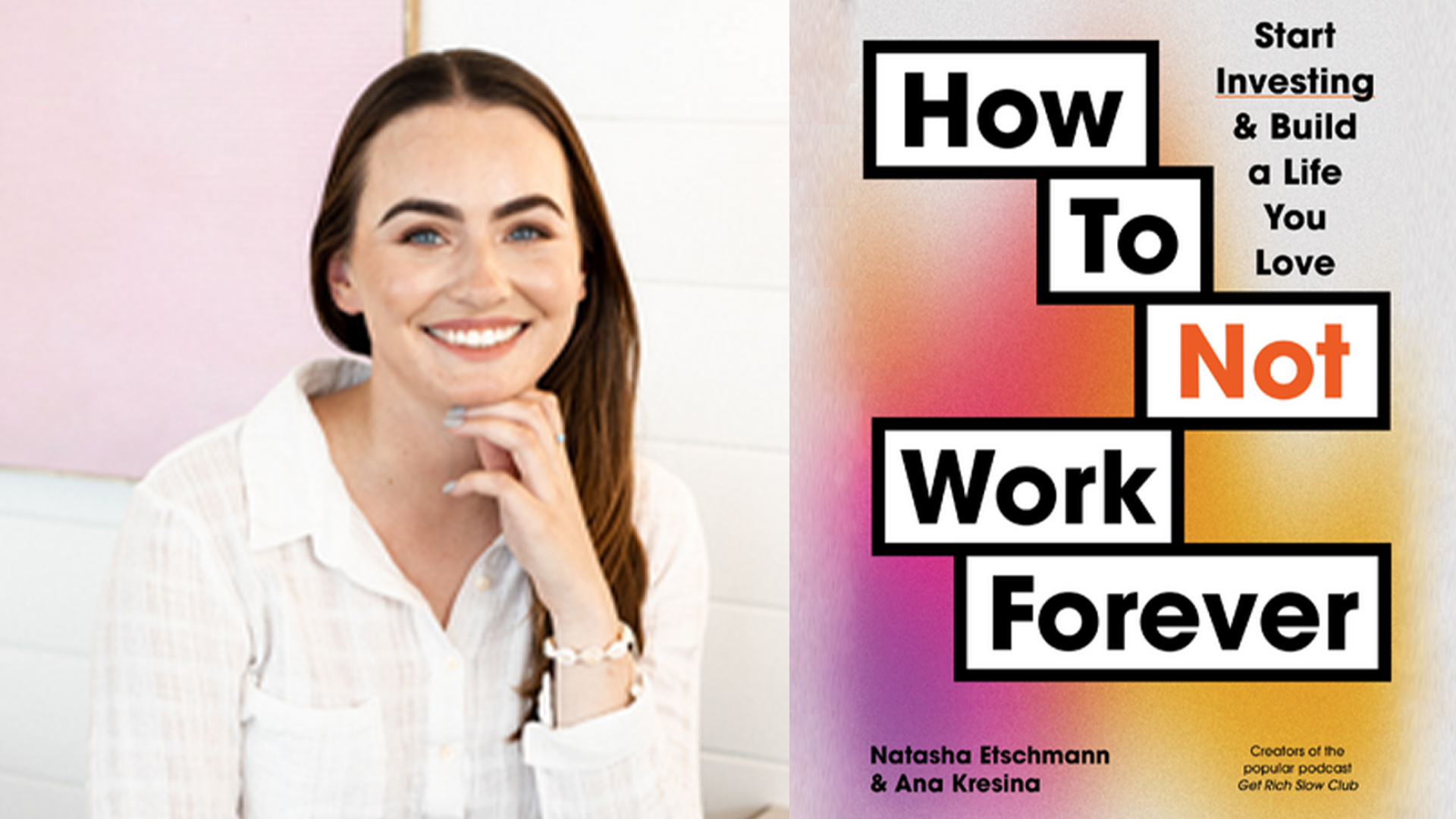

Edited extract from How To Not Work Forever by Natasha Etschmann and Ana Kresina (Wiley $32.95), available at all leading retailers.

The information contained on this web page is of general nature only and has been prepared without taking into consideration your objectives, needs and financial situation. You should check with a financial professional before making any decisions. Any opinions expressed within an article are those of the author and do not specifically reflect the views of Compare Club Australia Pty Ltd.